Pre-Qualify Now

Pre-Qualify Now

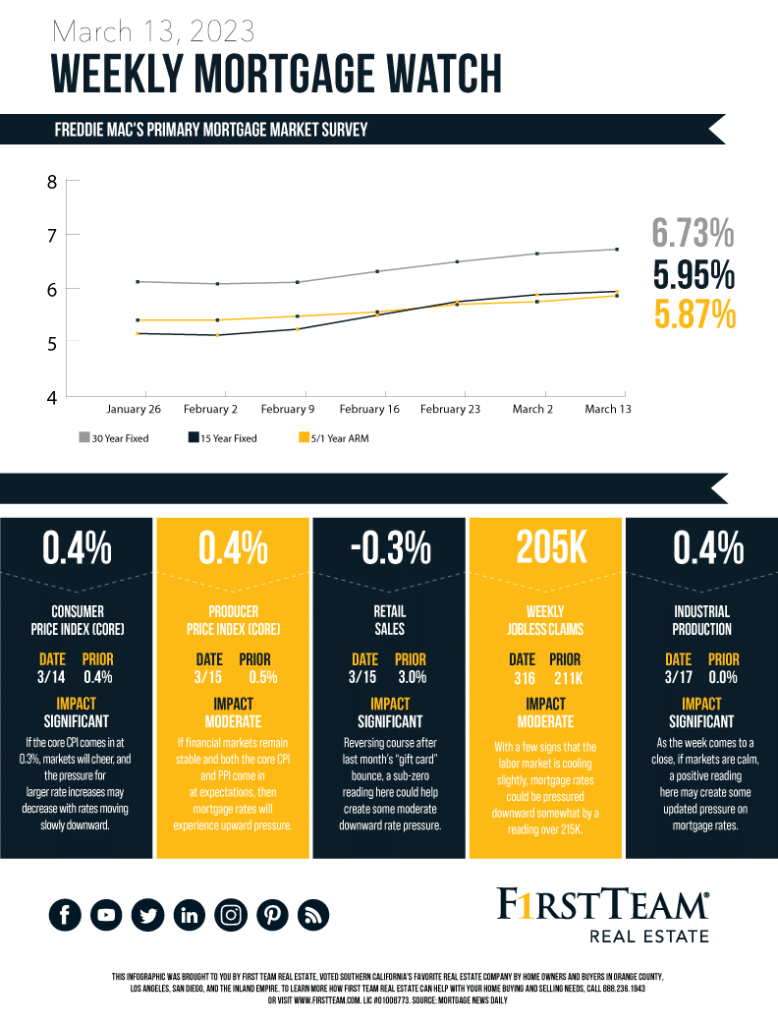

To find out if now is the time to buy, check out this week’s mortgage highlights:

(For more in-depth info about the market, click here!

- Last week was a roller coaster for financial markets. Fed Chair Powell’s testimony before Congress pushed rates and stocks upward

- His testimony appeared to reinforce the idea that the Fed would return to larger rate increases at their next meeting, as much of the recent economic data suggested.

- Silicon Valley Bank (SVB) imploded, becoming the second-largest banking failure in US history.

- Friday’s employment report, showing another 311K new jobs created, should have pressed mortgage rates upward, but SVB’s failure caused money to rush into the relative security of US Treasuries and began generating downward pressure on mortgage rates.

- Over the weekend, federal regulators began enacting emergency measures to backstop the banking industry, including taking over another failing bank, the third largest US banking failure.

- These moves, combined with at or above-expectations inflationary readings, could generate some upward pressure on rates, but it could be limited as markets sort out the Fed moves and repercussions.

Young Adults Ready to Begin Homeownership

Pushed home in record numbers, many young adults appear ready and able to purchase a home. While perhaps not ideal for many young adults, the time at home has given them an opportunity to decrease debt, improve credit scores, and build up savings. Over the last two years, the percentage of young adults at home has decreased by about 2%, and the trend seems to be accelerating.

The Ultimate Buyer’s Guide to Mortgages and FHA Loans

Making the decision to buy a home is both an exciting and terrifying time…

5 Common Mortgages for Homebuyers

Financing your home purchase is the most important part of buying a home…